Financial Wellness Services

As a Certified B Corp, one of our missions is to increase access to financial services for those who need them. These services are included for all our wealth management clients at no additional cost, but we have gone a step further and made our services available to everyone who needs them, on a sliding fee scale based on your ability to pay so that we can work on whatever problem brought you to us without having to sell you products or services you don’t want or need. This option is typically best for clients who need our services for a single engagement, or to solve a limited set of issues that don’t require a financial product to solve, just our advice. Services include:

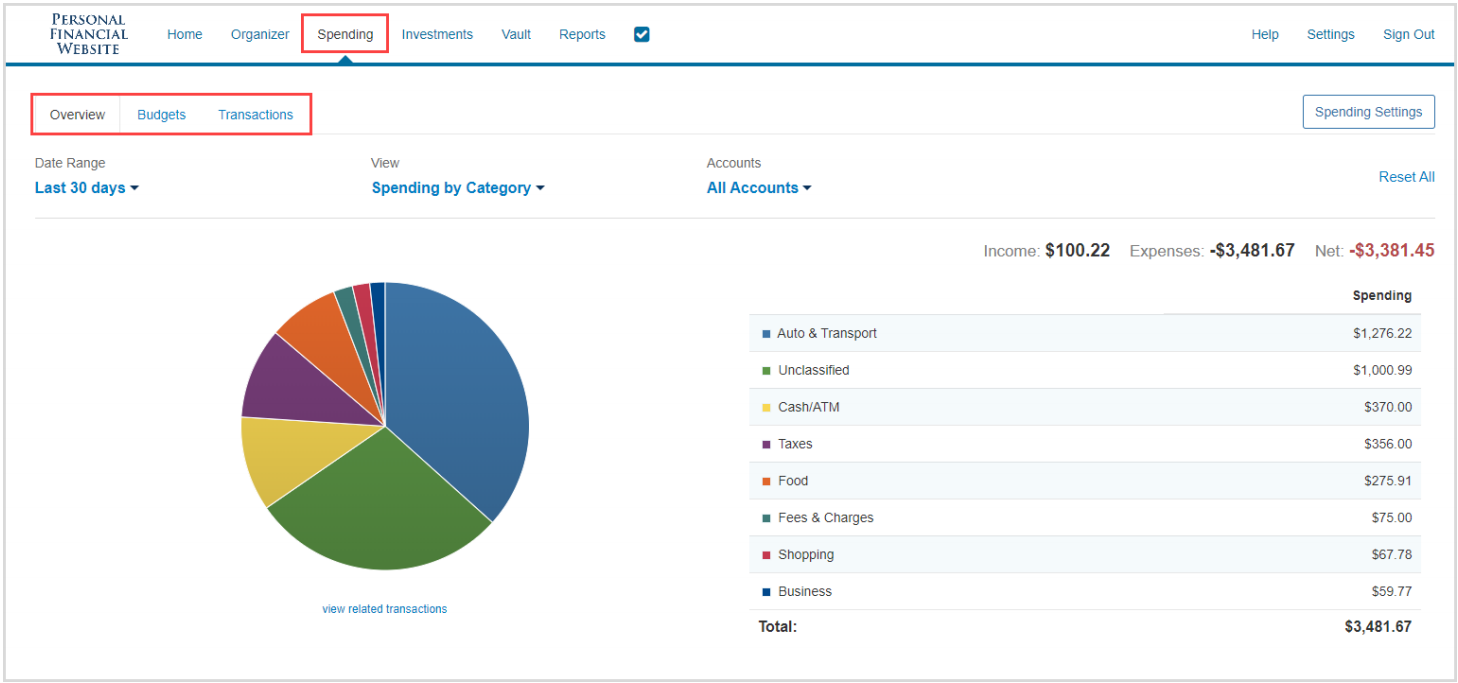

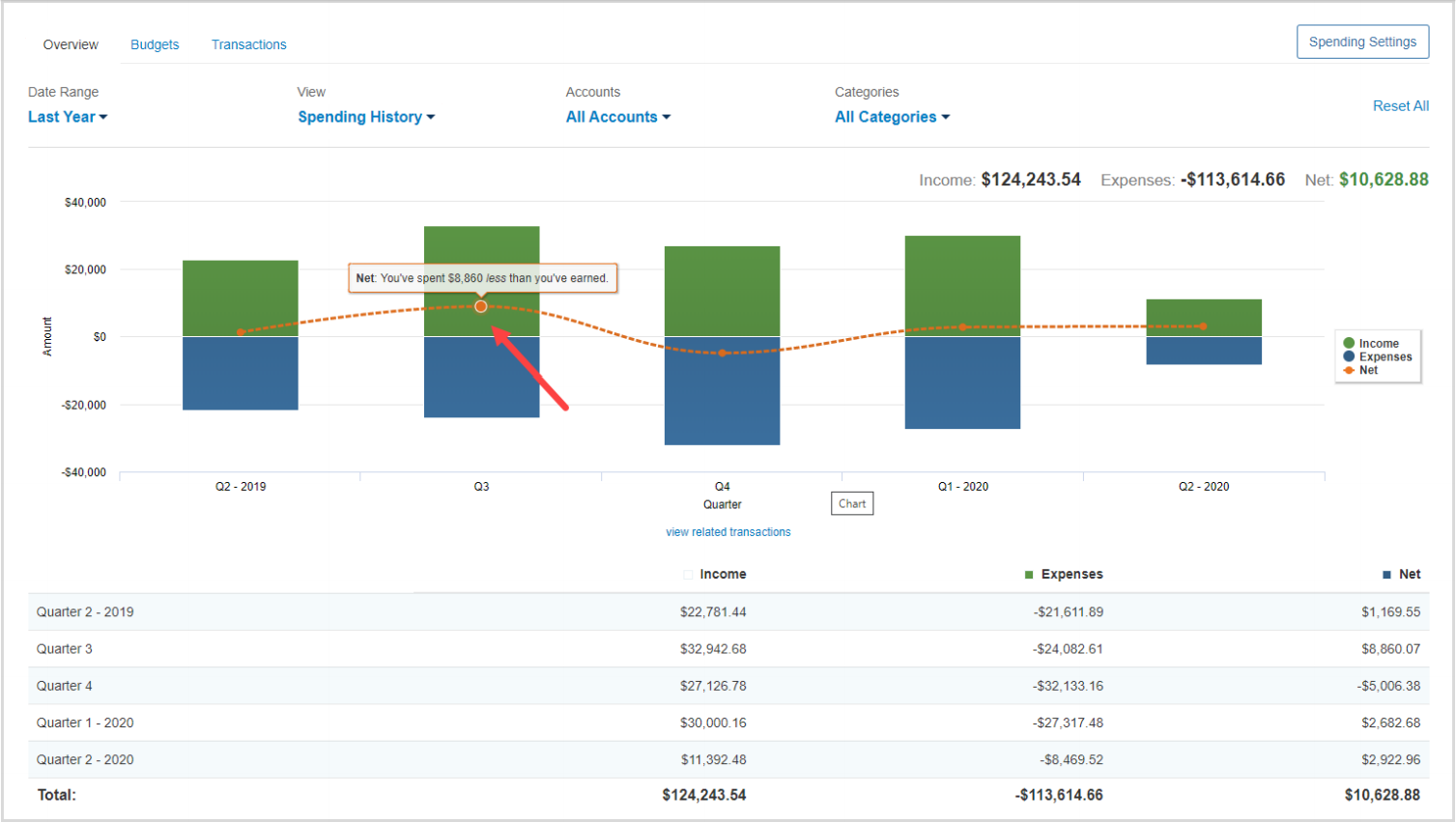

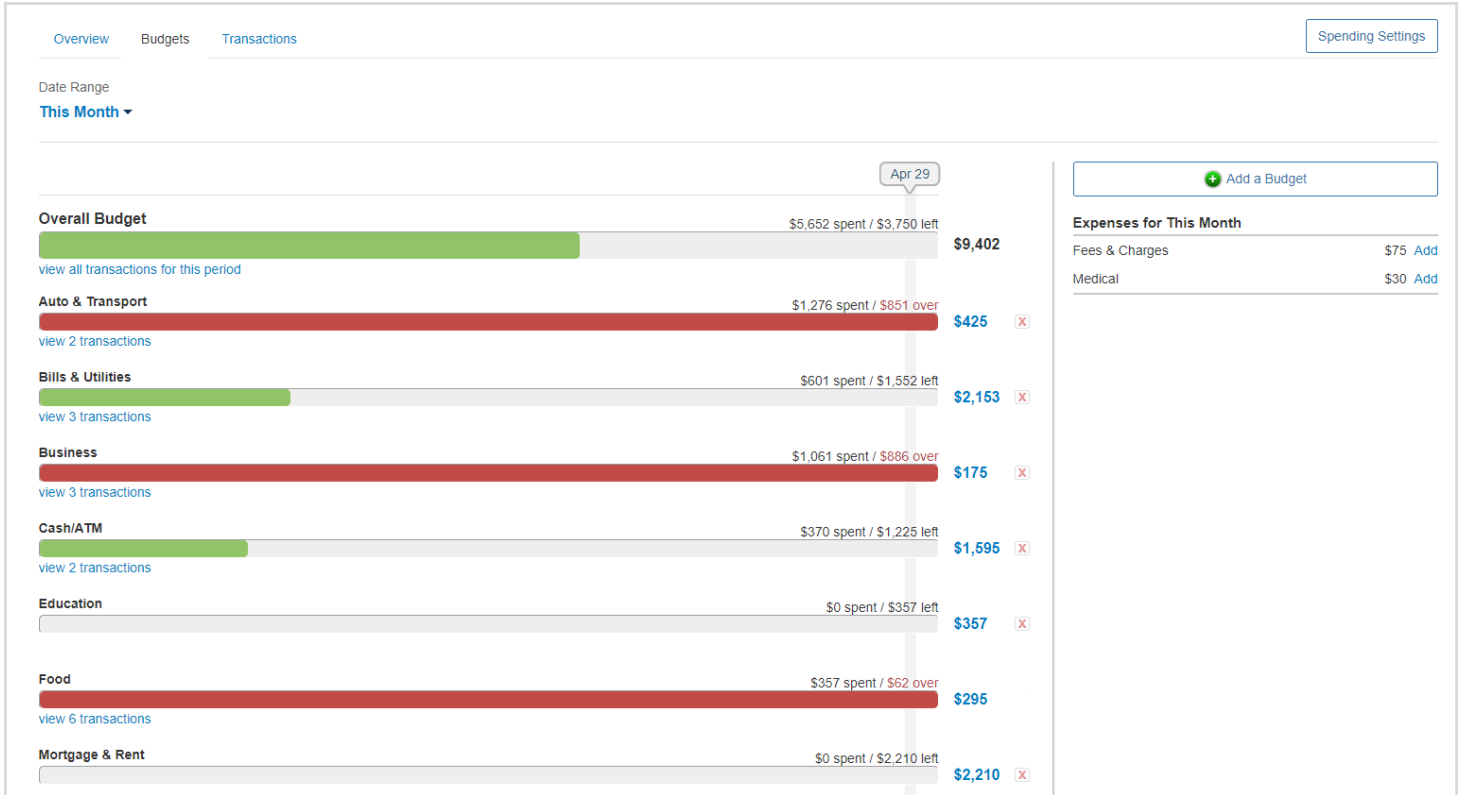

Budgeting • Cash Flow • Debt • Credit • College Funding • Student Loans• Home buying • Marriage & Divorce • Retirement • Insurance • Investment Strategy• Estate Planning • LGBTQIA+ Issues • And more.

We’re committed to being a “no-minimum” firm, so we’ve developed this fee schedule to enable us to cover our overhead while still helping those who need our assistance, and because we never want you to feel like we have to sell a product to get paid. We view financial products as potential solutions to whatever brings you in the door. If a financial product is a suitable solution for your needs, and we earn a commission as a result of our work together, our fee is waived. We also have no minimums on our investment work, and this can, depending on the size of your accounts with us, waive our fee as well. We are always happy to discuss this further and answer any questions, so just click the link on the bottom right corner of this page to schedule an appointment.

Fee Schedule

Income Hourly Fee*

$ 45,000 $ 75.00

$ 60,000 $ 100.00

$ 100,000 $ 125.00

(*Note: We reserve the right to determine the length of the hour. All hours start at 60 minutes, but we adopt Einstein’s’ theory that time is relative and some hours can actually be longer than others)

However you choose to work with us, our practice covers these areas:

We are very proud of the holistic nature of our work, and have created a Cadre of Allied Professionals* in order to fully meet our mantra of “Empowering Financial Wellness.” We are driven to make sure our clients and their families have their entire financial houses in order, and have discovered that we need to have a group of ‘experts’ to turn to for the “heavy lifting!”

Want to Learn More?

Let’s get together, either in person or virtually.

* Common Interests, Max Mintz, Robert Goellner, Vanderbilt Securities LLC, Vanderbilt Advisory Services or any employee, officer, or director are not responsible for any actions or inaction taken or not taken by any member of the “Cadre of Allied Professionals” (“CAP”); and no person or entity listed herein receives any hard dollars or soft dollars from persons or entities that are part of the Common Interest “CAP” and/or any person employed by any entity in the CAP