Common Interests is proud to be a part of the global investor network, including Amundi, California State Teachers’ Retirement System (CalSTRS), Legal & General Investment Management, Natixis Investment Managers, Mitsubishi UFJ Financial Group, and Sumitomo Trust Mitsui Asset Management, making up a record number of signatories to the Global Investor Statement to Governments on Climate Change.

Today, we are joining with investors from around the globe to urge world government leaders to step up their ambition on climate change and enact strong policies by 2020 to achieve the goals of the Paris Agreement, including phasing out thermal coal power and pricing carbon. 477 investors with $34 trillion (USD) in assets, a record number of signatories, are behind the urgent call-to-action to limit average global temperature rise to no more than 1.5-degrees Celsius.

“As institutional investors with millions of beneficiaries around the world, we reiterate our full support for the Paris Agreement and strongly urge all governments to implement the actions that are needed to achieve the goals of the Agreement, with the utmost urgency,” the investors wrote in a Global Investor Statement to Governments on Climate Change.

The statement comes as world government leaders gather at the Group of Twenty (G20) Summit in Osaka, Japan and as the United Nations Secretary-General António Guterres calls on “countries to build no new coal power plants after 2020.”

“Climate change affects all sectors of the economy and all countries,” said Christiana Figueres, Convener of Mission 2020 and former Executive Secretary of the United Nations Framework Convention on Climate Change (UNFCCC). “It is the biggest and most urgent challenge currently facing the world. As we face a true climate emergency, limiting temperature increase to 1.5-degrees Celsius is necessary for survival, and achievable!”

Figueres added, “Investors have a vital role to play in providing the trillions in capital required to support the transition to a low-carbon and climate-resilient future. It is therefore hugely encouraging to see so many investors unite around such a clear and powerful statement to governments. They are showing a sentiment shared across the global community: exponential scale-up and acceleration of climate action is not a choice but a requirement, and represents our best opportunities for financial stability and economic prosperity.”

“As an investor in global markets, we are exposed to the increasing risks and opportunities that climate change presents to our portfolios, especially in Asia where the physical impacts of extreme weather events will be the harshest and of the greatest cost,” said Seiji Kawazoe, Senior Stewardship Officer, Sumitomo Mitsui Trust Asset Management. “To enable us to effectively invest in the necessary transition to net-zero carbon economies around the world, we have signed this statement to urge governments to take the actions needed to set us on the course to limiting global warming to 1.5-degrees Celsius.”

In particular, investors are asking world government leaders to:

Achieve the Paris Agreement’s goals

- Update and strengthen nationally-determined contributions to meet the emissions reduction goal of the Paris Agreement, starting the process now and completing it no later than 2020, and focusing swiftly on implementation

- Formulate and communicate long-term emission reduction strategies

- Align all climate- related policy frameworks holistically with the goals of the Paris Agreement

- Support a just transition to a low carbon economy.

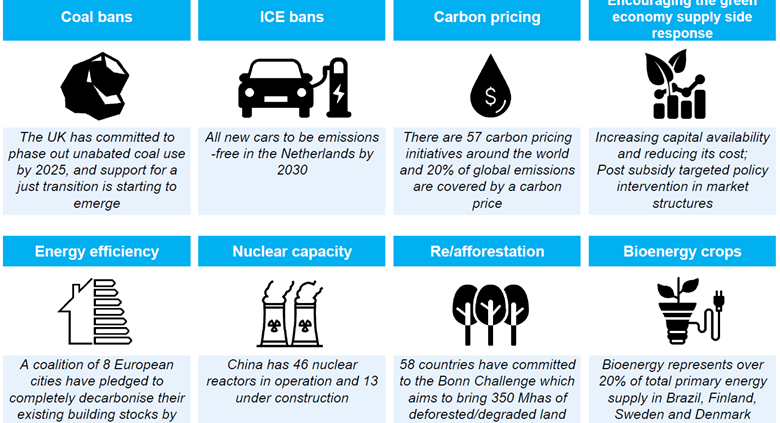

Accelerate private sector investment into the low carbon transition

- Incorporate Paris-aligned climate scenarios into all relevant policy frameworks and energy transition pathways

- Phase out thermal coal power worldwide by set deadlines.

- Put a meaningful price on carbon

- Phase out fossil fuel subsidies by set deadlines

Commit to improve climate-related financial reporting

- Publicly support the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) recommendations and the extension of its term

- Commit to implement the TCFD recommendations in their jurisdictions, no later than 2020

- Request the FSB incorporate the TCFD recommendations into its guidelines

- Request international standard-setting bodies incorporate the TCFD recommendations into their standards.

“As shareholders, we are engaging with companies about their emissions, and how their Boards and their business plans are preparing them for a carbon constrained future,” said the California State Teachers’ Retirement System (CalSTRS) CEO Jack Ehnes. “We need the governments of the world to implement the Paris Agreement and regulate emissions on a clear timeline so that businesses know what the interim targets are and the timeline for their action.”

“Renewables are the cheapest energy source across more than two-thirds of the world today. The direction of travel is clear: the economics of wind and solar will continue improving,” adds Carola van Lamoen, Head of Active Ownership, Robeco, a global asset manager with $203 billion in assets under management. “Renewables are expected to outcompete new coal-fired power plants by 2030 almost everywhere. As investors, in our view the development of new coal power plants after 2020 puts at risk both the return on investment and the world’s chance of limiting global warming in line with the goals of the Paris Agreement.”

“As one of Australia’s largest industry superannuation funds, and a major institutional investor, we believe we have an important role to play in bringing about positive action on climate change to protect the retirement savings of our members,” said Deanne Stewart, Chief Executive Officer, First State Super. “This aligns with the view of regulators in Australia, and internationally, who have identified climate change as a significant material and foreseeable risk and have called for immediate action. While we are responding on behalf of our members, this issue will require a coordinated, collective and collaborate response from governments, business and investors to ensure that critical changes are made now for the long-term interests of our members and the community.”

The Investor Agenda Founding Partners strongly welcomed the Intergovernmental Panel on Climate Change’s (IPCC) Special Report on 1.5-degrees Celsius which emphasised the urgency for average annual sustainable energy investments of up to USD $830 billion to transition to a zero-carbon and climate resilient global economy. The report also said that in order to achieve a 1.5-degree Celsius pathway, global net emissions need to decline by 45 percent by 2030 and reach net zero emissions around 2050.

The statement was drafted through a collaboration among seven partner organisations – AIGCC, CDP, Ceres, IGCC, IIGCC, PRI and UNEP-FI – that are the Founding Partners of The Investor Agenda. Launched in 2018, The Investor Agenda calls on investors to step up action on climate change in four key focus areas: Investment, Corporate Engagement, Investor Disclosure and Policy Advocacy. Signing the statement is one of the actions investors can take in line with the policy focus areas of the agenda. The statement is published at www.theinvestoragenda.org.

About The Investor Agenda

The Investor Agenda has been developed for investors to accelerate and scale up the actions that are critical to tackling climate change and achieving the goals of the Paris Agreement with the aim of keeping average global temperature rise to no more than 1.5-degrees Celsius. It provides investors with a set of actions that they can take in four key focus areas: Investment, Corporate Engagement, Investor Disclosure and Policy Advocacy. It has been developed by seven Founding Partners: Asia Investor Group on Climate Change,CDP, Ceres, Investor Group on Climate Change, Institutional Investors Group on Climate Change, Principles for Responsible Investment and UNEP Finance Initiative. Visit www.TheInvestorAgenda.org for more information.