ESG Investing Basics: What are we trying do to?

We talk a lot about ESG: Environmental, Social and Governance. Our investment thesis is based on the idea that this “extra-financial” data (meaning this is information that doesn’t necessarily show up on a company’s balance sheet or profit and loss statement) can have a material impact on the long term health and performance of a company.

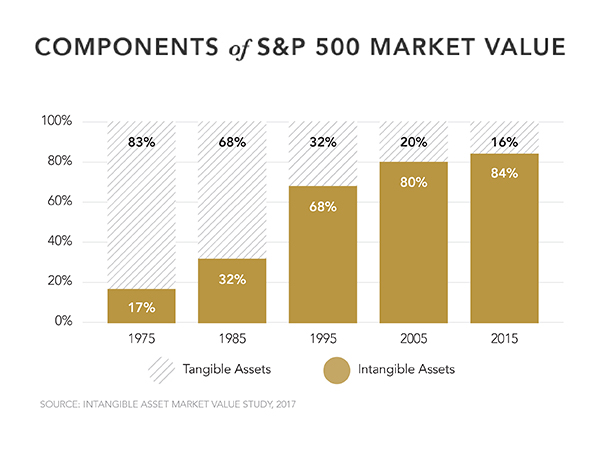

A great way to think about why we believe this is to look at this chart, which shows how the value of the companies in the S&P 500 index have changed over time, from the 70’s, when the vast majority of a company’s value was tangible, based on things, which can be measured. Over the past 4 decades, this has flipped, to the point where the vast majority of a company’s value is now based on intangible assets: things like good will, brand strength, and customer loyalty.

Tangible vs Intangible Assets as share of S&P 500 Market Value

As investors concerned with managing risk, we need data tools that look beyond the single bottom line of profits and financial data to understand how a company manages its’ Triple Bottom Line: People, the Planet and Profit. Taken together, these factors give us a more holistic look at companies, which helps us make better decisions. For example: a 2012 study by the Center for American Progress found that the cost to replace an employee is between 16% and 21% of that employee’s salary, and that quit rates are often due to workplace policies.

There are many ways to use this data, and we work with our clients to figure out which approach best matches their goals, both from a risk & return standpoint, and also thinking about the impact they want to have on the world. There are a number of different ways to use the data, and we’ve put together this handy chart to demonstrate the different approaches:

| Negative Screening | ESG Integration | Thematic Investing | Impact Investing | |

|---|---|---|---|---|

| Objective | Avoid companies or industries that you find objectionable: a “Clean” portfolio | Use ESG ratings as part of the investment process: Try to own the “Best in class” | Focus on specific issues that matter to you | Focus on non-financial outcomes in addition to financial outcomes |

| Challenges | Defining your screens & building a diversified portfolio that excludes the ‘right’ companies for you – how deep do you want to go? | Where is the ESG data coming from? How is it being used in the process? How will different ESG methodologies result in different portfolios? | Tend to be specific, narrowly focused investments. Only appropriate for a percentage of an overall portfolio | Report on progress & outcomes. How do we know our investments are doing what they say they are? |

| Examples | Avoiding investments in Fossil Fuels, Addictive products, or the manufacture of Weapons of War | Index funds that track ESG indices, active funds that exclude low ESG scored companies from their “investable universe” | Investments in Water, Gender Diversity, Clean Energy, or Low Carbon | Specific bonds such as Green Bonds, Community Investment Bonds, investments in private companies that have a social or environmental mission. |

We offer investment portfolios or individual investments tailored to each approach. Get in touch to learn more!

Trackbacks & Pingbacks

[…] do sustainably source the their products, they usually advertise that (as they should). In fact, many companies also now integrate ESG (Environmental, Social, and Governance) factors into their business models. In the past, the vast majority of a company’s value used to be based […]

Comments are closed.