Ahead of next week’s United Nations Climate Action Summit, a record 515 institutional investors managing $35 trillion in assets urged governments worldwide to step up action to tackle climate change and achieve the Paris Agreement’s goals.

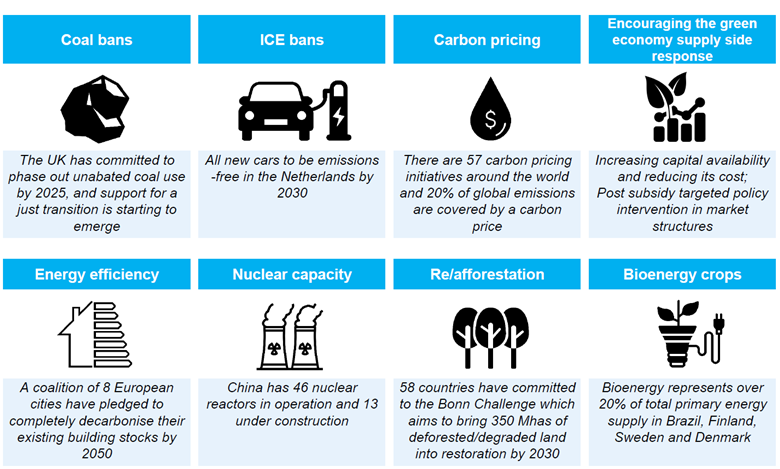

The Global Investor Statement to Governments on Climate Change, developed by the seven Founding Partners of The Investor Agenda, calls on governments to phase out thermal coal power worldwide, put a meaningful price on carbon pollution, end government subsidies for fossil fuels, and update and strengthen nationally-determined contributions to meet the emissions reduction

goal of the Paris Agreement no later than 2020.

“The global shift to clean energy is underway, but much more needs to be done by governments to accelerate the low carbon transition and to improve the resilience of our economy, society and

the financial system to climate risks,” the investors wrote. They warned the current government commitments leave an “ambition gap” that will not prevent global average temperature from rising

beyond the 1.5 degree threshold that scientists warn could trigger catastrophic and irreversible effects of climate change.

The investors’ call to action published today comes as UN Secretary-General António Guterres is asking all leaders, from governments and the private sector, to present plans – at the UN Climate Action Summit on September 23 or at the latest by December 2020 – to cut greenhouse gas emissions 45% by 2030 and reach carbon neutrality by 2050. “I am also asking all investors to scale up green ventures, to increase lending for low-carbon solutions and to stop, in effect, financing pollution,” Secretary-General António Guterres said at a preparatory meeting for the

Summit.

Signing the Global Investor Statement to Governments on Climate Change is an action item in the Policy Advocacy focus area of the The Investor Agenda. Launched in September 2018 by seven Founding Partners — Asia Investor Group on Climate Change, CDP, Ceres, Investor Group on Climate Change, Institutional Investors Group on Climate Change, Principles for Responsible Investment and UNEP Finance Initiative — The Investor Agenda is a collaborative initiative that aims to accelerate and scale up the investor actions worldwide that are critical to tackling climate change and achieving the goals of the Paris Agreement with the aim of keeping global average temperature rise to no more than 1.5-degrees Celsius. It provides investors with a set of actions

that they can take in four key focus areas: Investment, Corporate Engagement, Investor Disclosure and Policy Advocacy.

The Founding Partners also announced today the release of The Investor Agenda Annual Progress Report, which found that nearly 1,200 investors have taken action in one or more of the focus areas of The Investor Agenda. More than 750 investors have engaged with or directly influenced portfolio companies to act on climate change, more than 400 investors have stepped up their own disclosure on climate change, and more than 260 have set a climate target.

“Investors are stepping up their response to climate change and increasingly aligning their investment with the goals of the Paris Agreement,” said Rebecca Mikula-Wright, Director, Asia Investor Group on Climate Change (AIGCC). “The Investor Agenda has a pivotal role to play as a platform for supporting investors to lead ambition and catalyse sustainable investment, whilepromoting engagement across all regions and jurisdictions.”

“The Investor Agenda provides an unprecedented global forum for investors to accelerate action on climate change and drive transformation of capital markets to deliver a 1.5-degrees Celsius economy. To do that investors need to take further action themselves, but also require stronger incentives from governments” said Paul Simpson, CDP CEO.

“The global reach and potential impact of The Investor Agenda and the global collaboration of the seven organizations are quite extraordinary,” noted Mindy Lubber, Ceres CEO and President. “With the immense power and influence that investors hold in our global economy, they have a tremendous opportunity and responsibility to act at the urgent pace and scale required to keep average global temperature rise to no more than 1.5-degrees Celsius.”

“By working with our peers globally and across the regions, we can scale up ambition and action to tackle climate change and deliver on the promise of the Paris Agreement,” said Emma Herd, Chief Executive Officer, Investor Group on Climate Change (IGCC). “Collaboration is the key to success, and investors must play our part. The Investor Agenda is the platform we need to drive real investor action at this crucial point in time.”

Climate change poses an unprecedented threat to the global economy,” said Stephanie Pfeifer, CEO of the Institutional Investors Group on Climate Change (IIGCC). “Investors representing nearly half the world’s invested capital are sending a clear message that they need to see far greater ambition from governments in addressing the climate crisis. A considerable number of countries have already committed to delivering net zero emission economies by 2050. Investors are asking that others now follow their lead.”

“The Investor Agenda has a critical role to play in compelling investors to act and bring about lasting change around climate,” said Fiona Reynolds, CEO of Principles for Responsible Investment (PRI). “Ambition and meaningful action from governments, business and the financial sector is imperative to curb the current trajectory of global warming. These groups must act now to curb the climate emergency the world is facing by reaching the goals of the Paris Agreement to realise 1.5-degrees Celsius.”

“There is a growing urgency for investors and corporations to act on climate change goals. As of today, temperatures have risen 1-degree Celsius above pre-industrial levels,” said Eric Usher, Head of UNEP Finance Initiative. “To keep the rise to within 1.5-degrees Celsius globally, leadership from within the investor community will be key. The Investor Agenda is one critical platform in supporting investors in their individual actions.”

About The Investor Agenda

The Investor Agenda is a collaborative initiative to accelerate and scale up the investor actions that are critical to tackling climate change and achieving the goals of the Paris Agreement with the aim of keeping average global temperature rise to no more than 1.5-degrees Celsius. It provides investors with a set of actions that they can take in four key focus areas: Investment, Corporate Engagement, Investor Disclosure and Policy Advocacy. It has been developed by seven Founding Partners: Asia Investor Group on Climate Change, CDP, Ceres, Investor Group on Climate Change, Institutional Investors Group on Climate Change, Principles for Responsible Investment and UNEP Finance Initiative. Visit www.TheInvestorAgenda.org for more information.