Portfolio Changes & Economic Commentary for Q3 2021

Looking ahead to the rest of the year and 2022, with a special focus on inflation projections

As we put the first half of 2021 behind us and look to the end of the year and beyond, one thing is on everyone’s minds: Inflation. We actually delayed this quarter’s model revisions until we could see what the June inflation numbers looked like, and we’re quite glad we did. Here’s a link to a piece from the NY Times (which avoids their paywall if you don’t have a subscription) that does an excellent job of showing what’s going on with inflation.

Here’s the good news: at the beginning of 2021, we repositioned our portfolios to account for this. As a result, we aren’t making large changes to our portfolios this quarter. We will be rebalancing the portfolios to keep them in line with your risk tolerance, and we had one fund close to new investors (so we’ve found an alternate for investors who do not currently own that particular fund), but for the most part this quarter, we are ‘staying the course’. A few notes:

- The Calvert Emerging Markets Equity Fund (CVMIX) recently closed to new investors. While we’ve used this fund on and off for many years, this forced us to look for an alternative. We have decided to hold this position for existing investors, and add in the Matthews Asia ESG Fund (MISFX) for new investors. While the reports below will show the Calvert Emerging Markets Fund being sold, we have set this fund as an alternate in our management software, which means that it will not be sold if you currently own the fund. We will continue to monitor this fund, but our reporting going forward will use the Matthews Asia ESG Fund as the primary investment for these models.

-

This post is intended as a generic report on the changes we are making to our models. Our portfolio management techniques are designed to put us in control of the implications of trading, so if you would like an estimate of the tax consequences of these changes, please call us and we can discuss your individual situation and the implications both of making these changes and of holding off on them.

-

As we have discretion on your account, we will implement changes and rebalance your account in the next week unless we hear from you to the contrary.

-

- There’s a new addition to this announcement this quarter as well! We recently partnered with a new vendor, YourStake.org, to deliver sustainability reports. I just did a podcast with them, so please feel free to listen here (or wherever you get your podcasts) if you’d like to learn more about this partnership. With each model, you’ll find a sustainability report that highlights some of the metrics they can report on. If you don’t find these metrics relevant to you, we’re more than happy to customize the reporting to your values. Please click here to take a questionnaire if you’d like us to run you a custom impact report.

Before we get to the analysis and model updates, a quick plug for our newsletter. Some clients really liked getting more frequent updates from us, but many folks thought it was information overload. If you’re interested in weekly updates on the markets, click the button to the left to receive our weekly market updates. You will get one email with a summary of movements in the markets, economic news, and a few thoughts on the week ahead. We’re not turning this on for everyone (we really don’t want to overload you with things you don’t want to see) but it’s here for you if you’re interested! Click here to see the email we sent out on July 12 if you’d like to see what these emails look like.

5 reasons to be Bullish and 5 reasons to be Cautious

At the halfway point on the year, here are some pros and cons in the economy

Bullish Indicators

Recession is Unlikely

Typically, bear markets occur because of recessions. At the moment, earnings for S&P 500 companies look excellent. Data we’re watching from FactSet is extremely optimistic, and shows that hard hit industries, such as Airlines Hotels, & Restaurants are bouncing back strongly from the pandemic.

We believe central banks will continue to support the economy

While we believe the Federal Reserve is likely to begin ‘tapering’ its’ quantitative easing programs at the end of this year or the beginning of next year, we expect that they will continue to keep rates extremely low, which should support stock prices. Here’s an ugly chart from the OECD which tracks the consensus of economists in the eurozone – here’s what they’re thinking (read more here)

A LOT of cash is still on the sidelines

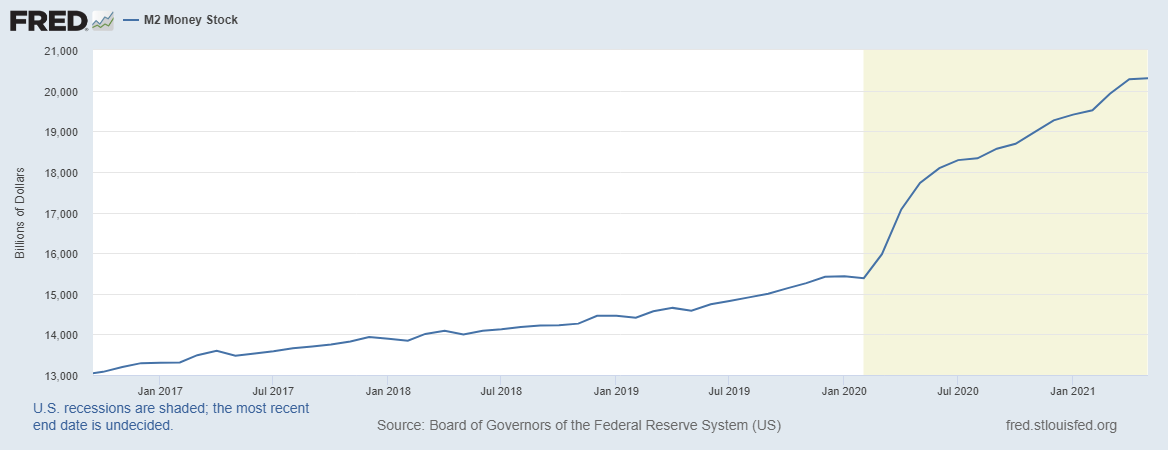

A LOT of cash is still on the sidelines. We’ve highlighted this chart before, which shows the growth of the “M2” Money Stock, which measures cash in checking and savings accounts, plus the cash in money markets and held by mutual funds (read more here). We’ve been monitoring this metric for some time, and continue to note that the growth in cash assets has continued, even after the direct stimulus checks which we believe caused the big leg up in the chart in 2020, ended. We see this as evidence that consumers and investors are in a strong position. (click on the chart below to make it bigger – I know it’s really small here)

Dividends and share buyback programs are increasing

What do companies do when they have a lot of cash on hand and feel good about the economy? They tend to return that money to their shareholders, either via dividends or share buybacks. This seems to be happening.

There is no alternative to stocks

According to the US Treasury, “Real Yields” on treasury bonds (aka, the current yield minus inflation) are negative across the board. This indicates that bonds are relatively unattractive compared to stocks – you can see this in your account, as the bond positions are the only ones that are negative for the year. This supports higher stock prices, as the dividends from stocks coupled with the potential for the increase in price drives more investors from bonds to stocks. This can increase the risk investors are taking. We have some ideas for alternatives to bonds, but those need to be discussed individually. Please get in touch if you’d like to explore your options.

Reasons to be Cautious

Bond-buying programs are about to slow down

This is a big one – we’re seeing central banks around the world begin to dial back the emergency stimulus they’ve been running since the beginning of the pandemic.

The potential for higher corporate taxes

The past few weeks have been a buzz of news, and we’re watching the efforts on a Global Minimum Tax of 15% on corporations closely. While we do not believe this will have a huge impact (the regulations aren’t scheduled to go into effect until 2023), it’s worth watching in the longer term.

The Covid-19 Delta Variant

I’ll just point you at this article... it does a better job than I could do on this one. Here’s more data if you want to get political.

Inflation may be here to stay

Neither we nor Jerome Powell, the chairman of the Federal Reserve believe that inflation is here to stay, but we could all be wrong. There are some reasons to suspect inflation may last longer than we anticipate.

Here are some thoughts from Andy Kaufman, chief investment officer at Community Capital Management, from their recent “5 questions in 5 minutes” series. Thanks to CCM for giving us permission to repost this here!

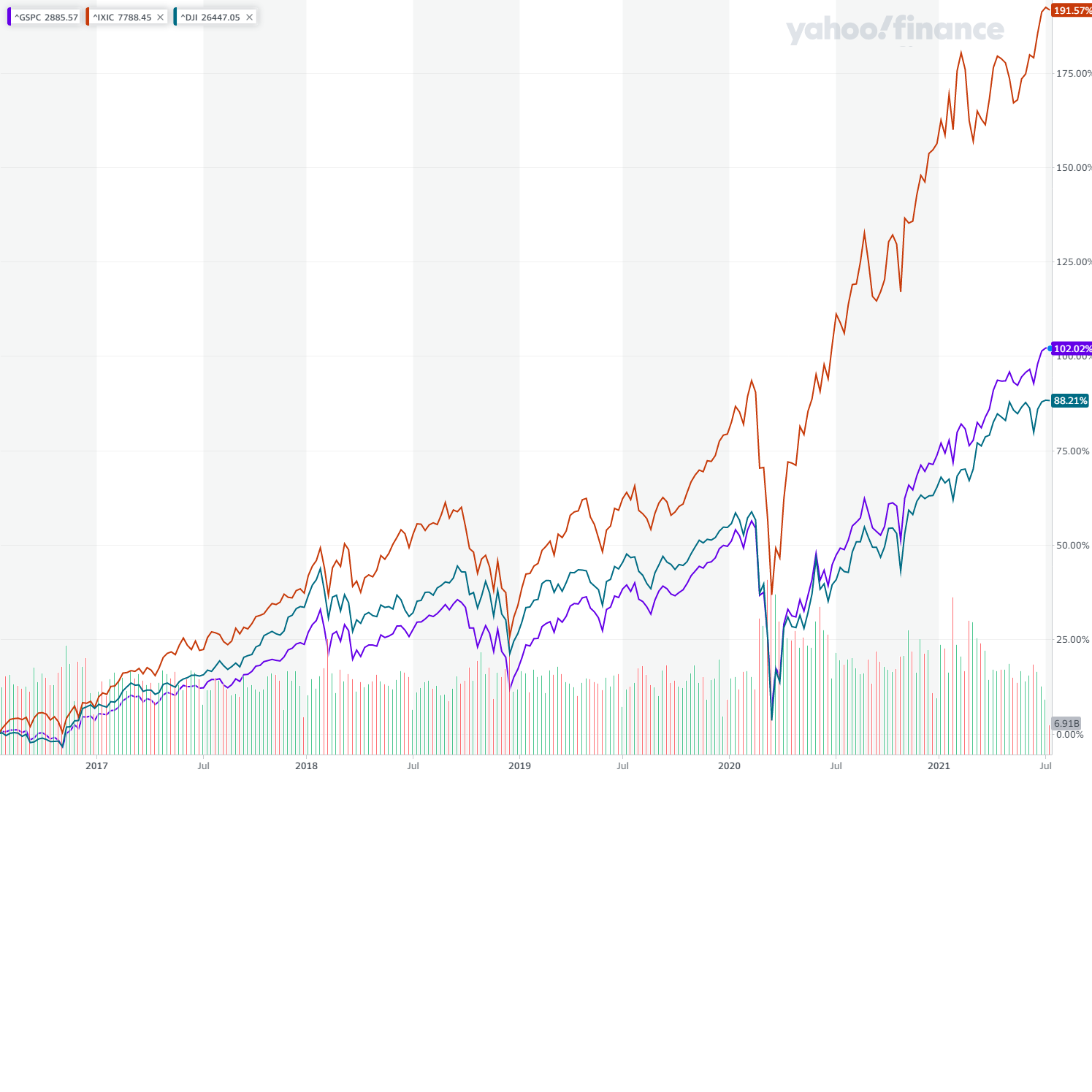

Stocks are at all time highs

Here’s a 5 year chart of the Dow (in green), the S&P 500 (in purple) and the NASDAQ (in red) from Yahoo Finance. Markets have posted spectacular returns over the past few years, which means the risk levels in our accounts have drifted more aggressive. If you’re concerned about a sizable drop in the markets, we should have a conversation about your risk tolerance. As we age, it is right and good that our investment objectives shift. This is a big part of the reason why we meet so regularly and have these conversations about your tolerance for risk. Call us if you’d like to chat! (and click on the image below to blow it up so you can actually read it)

Portfolio Changes

Please click the buttons below to see the changes to each model, or click into the areas below for more information.

On the last page of each report is an “Action Plan” that shows our Buy, Hold and Sell recommendations.

In addition to these changes, we will rebalance all accounts to bring them into alignment with the models.

All model portfolios are presented at a $100,000 value, & all performance numbers are quoted net of a 1% management fee.

Let us know what you think about the new Impact Reports!